Double declining method formula

Formula for Double Declining Balance Method. The double declining balance is.

Double Declining Balance Method Of Deprecitiation Formula Examples

Heres the formula for calculating the amount to be depreciated each year.

. 50 000 x 40. Double Declining Balance Method formula 2. Assess the straight-line depreciation rate eg.

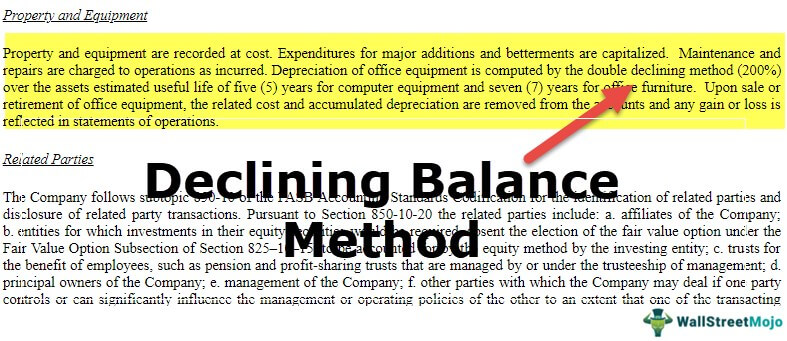

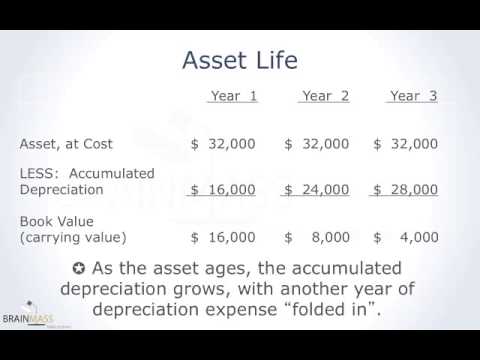

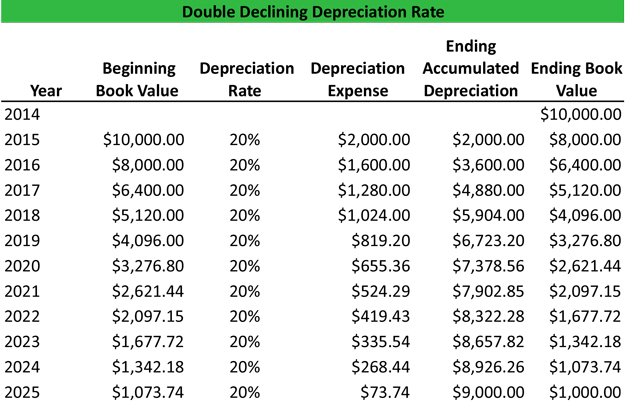

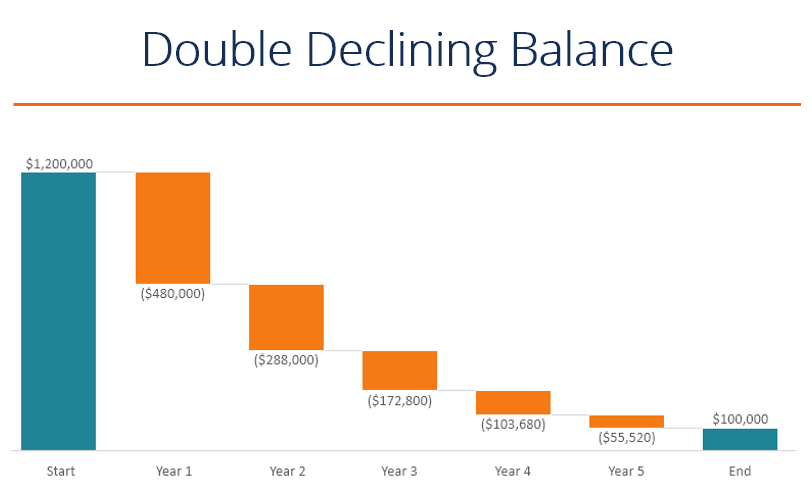

To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. The formula for depreciation under the double-declining method is as follows. The double declining balance depreciation method is an accelerated depreciation method that counts as an expense more rapidly when compared to straight-line depreciation that uses the.

When using the double-declining balance method be sure to use the following formula to make your calculations. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2. Double declining balance is calculated using this formula.

In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two. The double declining balance formula. While the total expense remains the same over the life.

Depreciation 2 Straight-line depreciation percent. The double declining balance method of depreciation also known as the 200 declining balance method of depreciation is a form of accelerated depreciation. First Divide 100 by the number of years.

Subtract the salvage value from your initial book value to begin the depreciation calculation eg 50000 5000 45000. Double declining balance depreciation Net book value x Depreciation rate. Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore.

The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset. It takes the straight line declining balance or sum of the year digits method. The DDB depreciation method is a little more complicated than the straight-line method.

20 x 2 40. 2 x basic depreciation rate x book value. This means that compared to.

The double-declining balance method computes depreciation at an accelerated rate - depreciation is highest in the first period and decreases in each successive period.

Depreciation Formula Examples With Excel Template

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Depreciation Daily Business

Double Declining Depreciation Efinancemanagement

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

The Double Declining Balance Method Of Depreciation Part 1 Of 2 Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Depreciation Examples Guide

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Of Depreciation Accounting Corner

Simple Tutorial Double Declining Balance Method Youtube