30+ mortgage deduction california

Medical and dental expenses. Web Disallow Second Home Mortgage Interest Deduction SUMMARY Under the Personal Income Tax Law this bill would reduce the home mortgage interest paid deduction and require the Franchise Tax Board FTB to annually estimate and report to the State Controllers Office SCO the expected or anticipated additional amounts of tax revenue.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web The limit on mortgage indebtedness for the home mortgage interest deduction is 1 million in California as of the 2022 tax year the return you file in 2023.

. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web With a mortgage interest deduction among other deductions you can bring your AGI down to 200000 to 250000 to fly right under the radar of the governments income threshold to increase taxes. Web Deduction CA allowable amount Federal allowable amount.

The mortgage interest deduction cap is being lowered. On home purchases up to 1000000. Compare offers from our partners side by side and find the perfect lender for you.

Web Under the expansion of Californias mortgage relief program being unveiled today at a Sacramento nonprofit. 300000 is really the amount of household income I think that is required to live a middle-class lifestyle today in a big city. Eligible homeowners who have already used the.

Expenses that exceed 75 of your federal AGI. Web Yes your employer can deduct money from your paycheck for coming to work late. We Have The Perfect Mortgage For Your Unique Needs.

For 2018 his itemized deductions including. Speak To Our Friendly And Experienced Bankers To Discover How. Expenses that exceed 75 of your federal AGI.

For example if you are in the 24 percent. Web Buyers can expect to pay about 3 6 of their loan amount on closing costs. Web For example Fiscal Tax Year 2018-19 runs from July 1 2018 through June 30 2019 and the Tax Roll Year is 2018-19.

For married taxpayers filing separate returns the cap. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Five-Pay Plan A five-year payment plan that allows defaulted property taxes to be paid in 20 percent increments of the redemption amount with interest along with the current year property taxes annually.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web What Credits and Deductions Do I Qualify for. On home purchases up to 750000.

Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web The amount you receive in tax deductions is dependent on your marginal tax rate also known as your tax bracket. California Mortgage Interest Deductions in 2018.

For example on a 200000 mortgage buyers can expect to pay 6000. Ad You Can Afford A New Home. Contact Our Experienced Brokers Now.

The deduction shall not however exceed the proportionate wage that would have been. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Tax Changes.

Homeowners who bought houses before December 16 2017 can deduct. A summary of changes under the tax cut bill. Lets explore the most common tax questions about closing cost tax deductions for homeowners.

Web He paid three points 3000 to get a 30-year 100000 mortgage and he made his first mortgage payment on Jan. Web According to this State of California website this deduction will allow deductions for home mortgage interest on mortgages up to 1 million plus up to. State Credits Deductions Standard Itemized Federal Tax credits Bad debt.

Find out which credits and deductions you can take. Web Most homeowners are familiar with two popular tax benefits of buying a home the mortgage interest deduction and the property tax deduction but some of the more confusing federal tax deductions are related to closing costs. Job Expenses and Certain Miscellaneous Itemized Deductions.

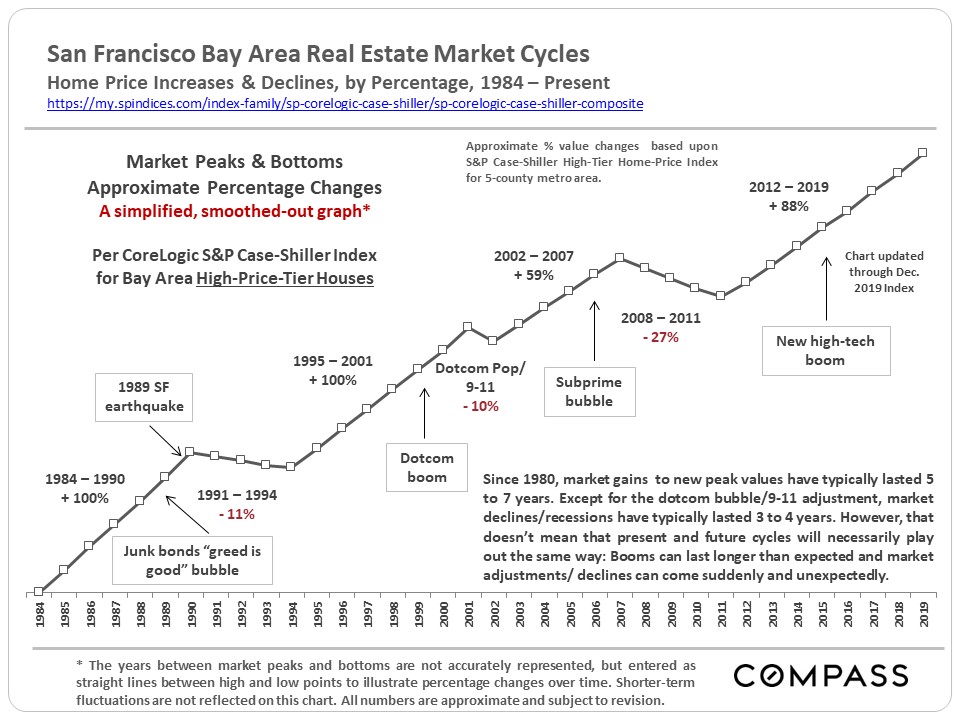

30 Years Of Bay Area Real Estate Cycles Compass Compass

Digital Identity Digital Benefits Hub

What Is Mortgage Interest Deduction Zillow

Californians Home Mortgage Deduction Would Be Capped Under New Bill

It S Time To Gut The Mortgage Interest Deduction

Mortgage Lender Woes Wolf Street

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

30 Years Of Housing Market Cycles In The San Francisco Bay Area Investsf

Mortgage Payment Tax Calculator Deduction Calculator

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Inheritance Tax On House California How Much To Pay And How To Avoid It

Mortgage Tax Deductions What Is Tax Deductible San Diego Purchase Loans

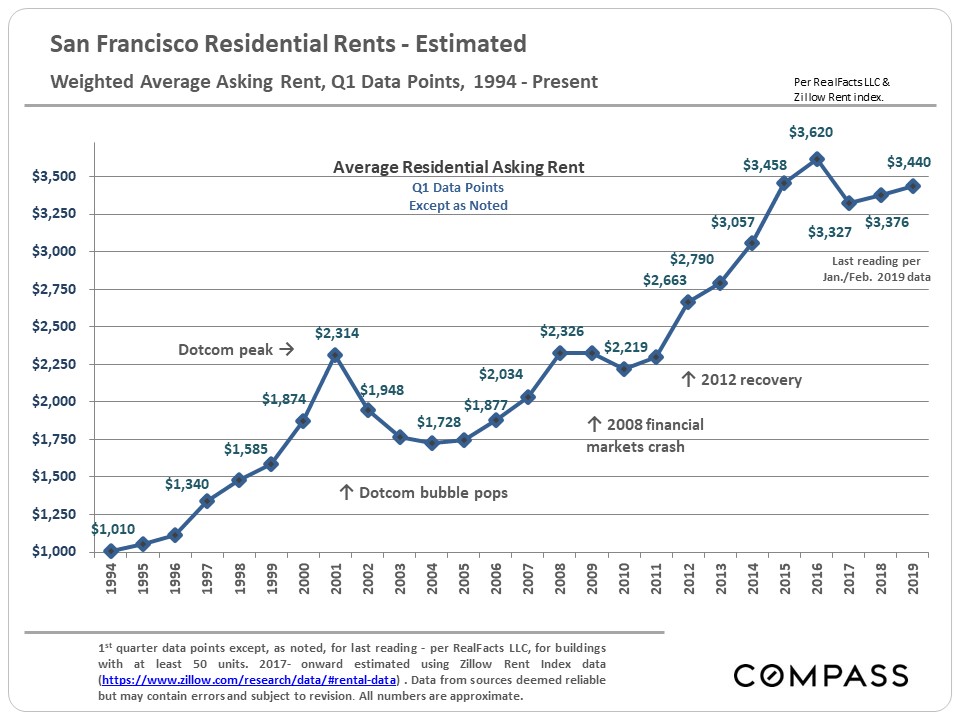

Income Affluence Poverty The Cost Of Housing Housing Affordability In The San Francisco Bay Area Home Team Paragon Real Estate

30 Years Of Bay Area Real Estate Cycles Compass Compass

Which States Benefit Most From The Home Mortgage Interest Deduction

30 Years Of Housing Market Cycles In The San Francisco Bay Area Investsf

Mortgage Lender Woes Wolf Street