20+ Timely Filing Calculator

All Medicare claims must be filed within one year after the date of service DOS. Holidays and more are built in to ensure you dont have to count days manually.

B9hbz9yybdgo9m

Web This is a nationwide test of the Emergency Alert System issued by the Federal Emergency Management Agency covering the United States from 1420 to 1450 hours.

. Web Claims Timely Filing Calculator. To calculate a deadline or filing well need you to follow these three steps. In general Medicare claims must be filed to the Medicare claims processing contractor no later than 12 months or 1 calendar year from the date.

Web Filing Date and Deadline Calculator - CalDepo. Enter the number of days you want to calculate from the start date. Web Count the number of days forward eg from the date of service or backward eg from the hearing date accordingly to determine the deadline by which you must act ie the.

Web Claim Timely Filing Calculator. Enter the date on your redeterminations decision letter to view the timely filing limit for your request. Web Claims Timely Filing Calculator.

Are not counted Using. STEP 1 Enter Number. Web Enter a start date and add or subtract any number of days months or years.

We will deny your form if you file more than 90. Select whether the deadline is before or after the start date. Web Do you want to calculate days forward or backward.

In general Medicare claims must be filed to the Medicare claims processing contractor no later than 12 months or 1 calendar year from the date. Web Claims Timely Filing Calculator. Choose how to calculate the time.

What date will it be 10 30 or 90 business days from today or any other date including or excluding weekends. Web This timeliness calculator determines the date a Reopening request must be received by Noridian in order to meet timeliness guidelines. How Many Days Until Your Deadline.

To determine the timely filing limit for your service please enter the date of service in MMDDYY or MMDDYYYY format and. Patient seen on 07202020 file claim by. All Days Calendar Days Business Days Only.

Pick the start date of your deadline. Identify a date in the past or future based on a specific number of days months or years. Web Deadline Filing Calculator.

Web You may use the USCIS Early Filing Calculator to ensure you file your Form N-400 within the 90-day window. New 2022 United States Deadline Calculator. To calculate a deadline or filing well need you to follow these three steps.

Count Days Add Days Workdays Add Workdays Weekday Week. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Enter Number of Days.

Enter the initial Remittance Advice RA. Web Use the Claims Timely Filing Calculator JH JL to determine the timely filing limit for your service. Business Days from Today or Any Date.

In general Medicare claims must be filed to the Medicare claims processing contractor no later than 12 months or 1 calendar year from the date. Web New York CNN Today is the day for the US governments big emergency alert drill which will send a test message to every TV radio and cell phone in the nation. Never miss a deadline again.

Enjoy Great Deals and Discounts On an Array Of Products From Various Brands. Ad Boost Your Productivity With Basic Scientific Graphing and Other Calculators. Web Calculate deadlines with ease with this free date calculator.

Enter the DOS to calculate the time limit for filing the claim. Web Claims Timely Filing Calculator. Web Business Date Calculator.

CGS online tools and calculators are informational and.

Tips To Maximise Your Small Business Tax Return

![]()

Timely Filing Calculator Medisoft Blog From 2k Medical

How Your Bonus Is Taxed

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

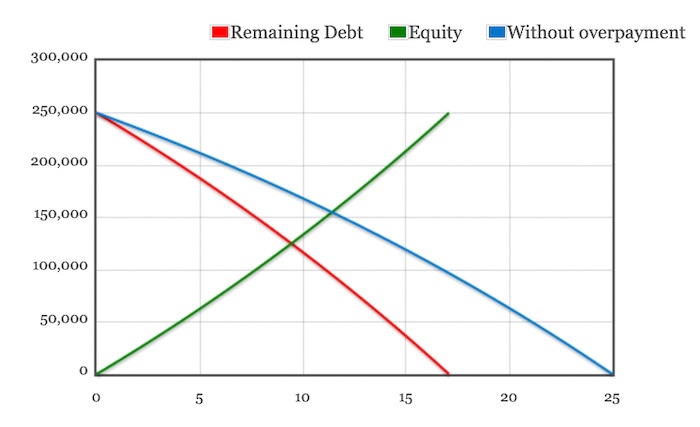

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

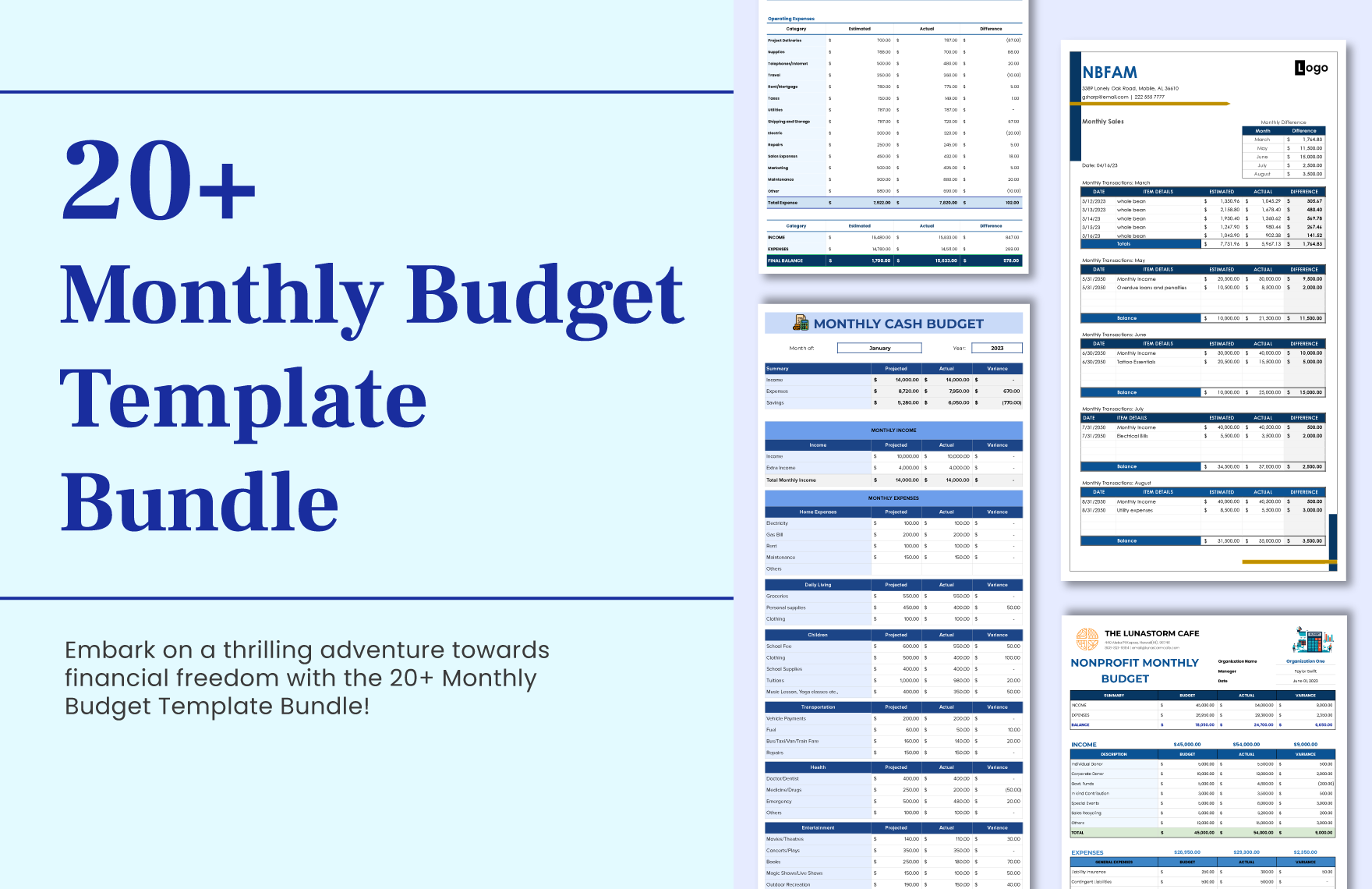

20 Monthly Budget Template Bundle Download In Excel Google Sheets Template Net

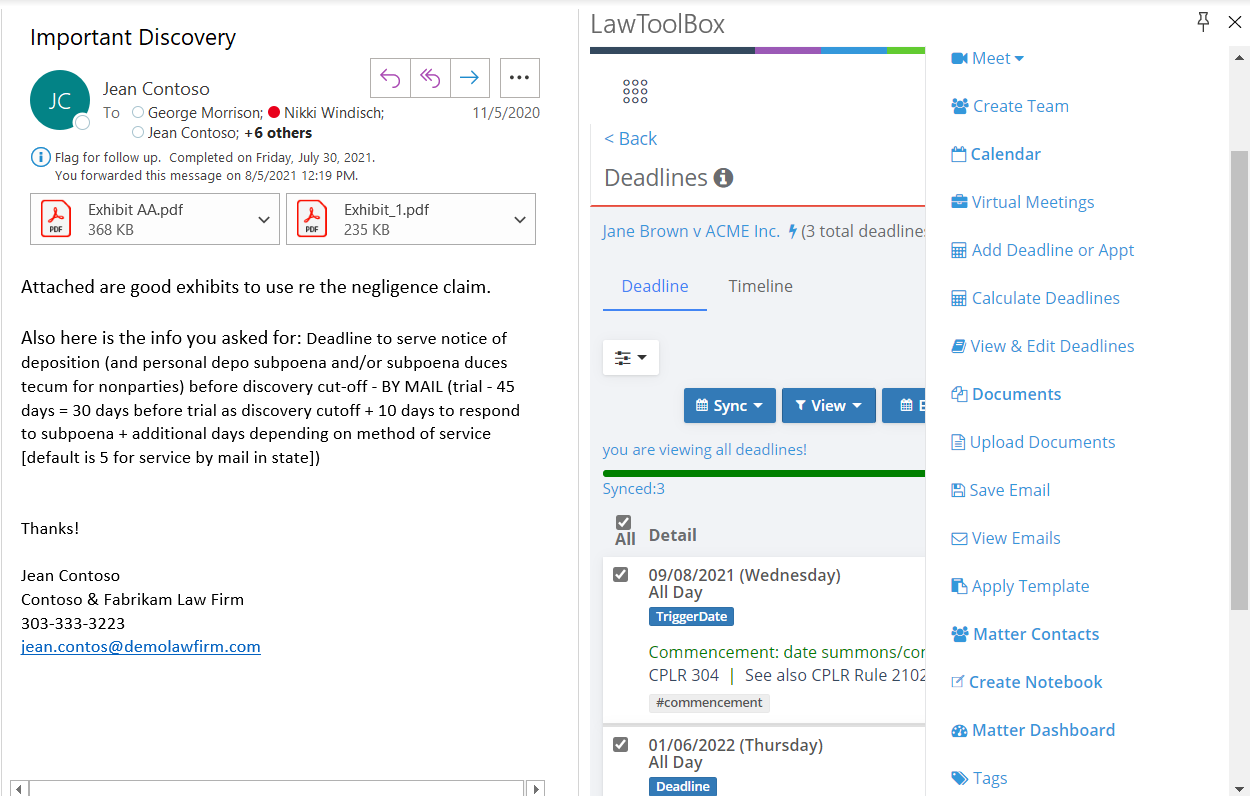

Legal Deadline Calculator Calculate Rules Based Deadlines

Deadlinecalculator Com Todd Olivas Associates V3 0 Court Reporting Services Orange County Riverside San Bernardino San Diego Los Angeles Irvine Santa Ana Orange San Jose Sacramento Fresno San Francisco

Fema Avs Associates

Tax Deductible Expenses For Sole Traders Taxkings

Bb 11 11 20 By State Bar Of New Mexico Issuu

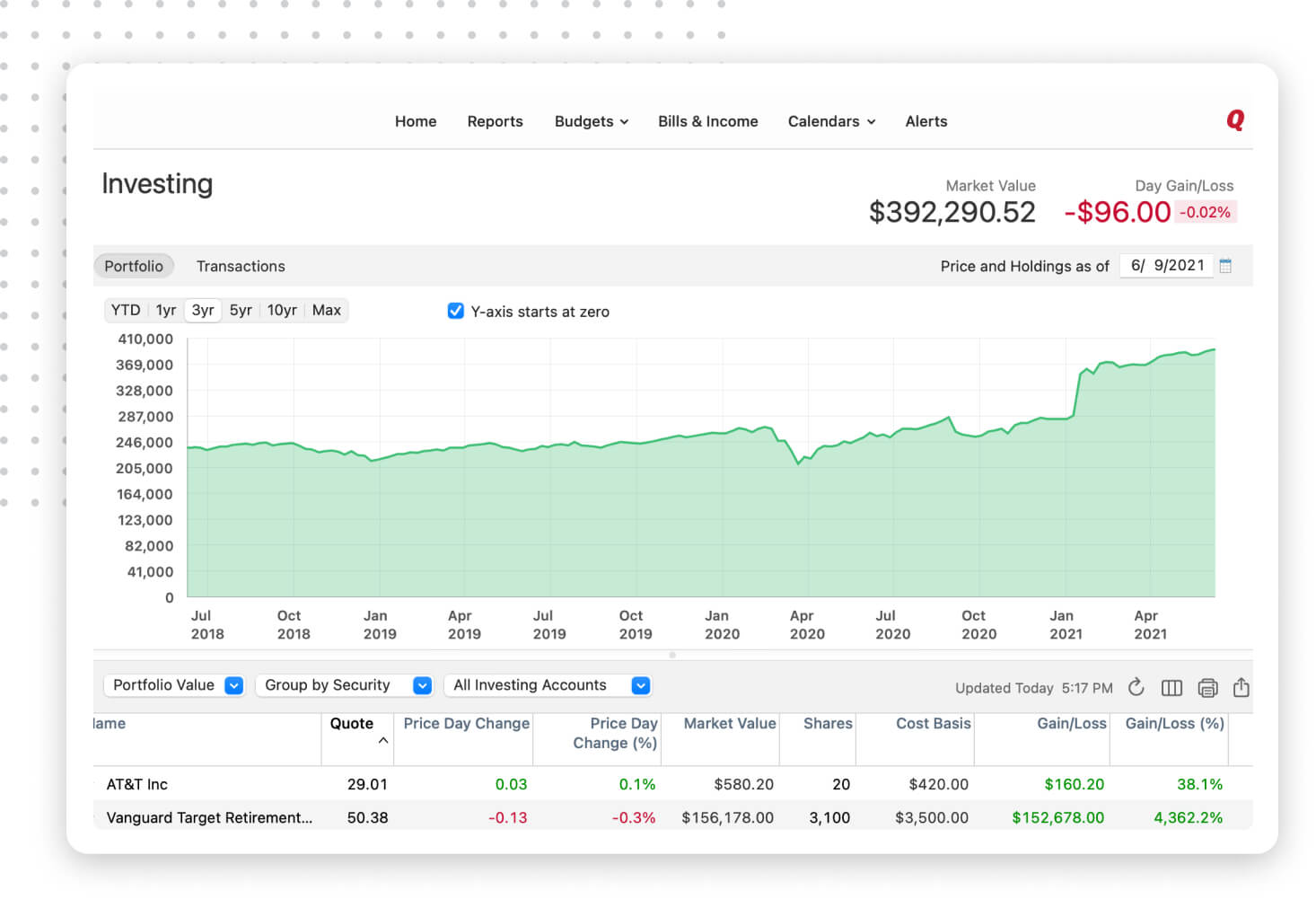

Quicken Retirement Planning Software Plan Your Retirement Today

Income Tax Management For A Freelancer Writer S Digest

Email Phishing Scams Spike In Tax Season Alta Pro Lawyers Risk Purchasing Group

Indian Retailer Term Life Insurance Calculator 5 Ways It Can Help You Plan Efficiently

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Tax Deducted At Source Tds Under Goods And Service Tax